"It won't be the economy that will do in investors; it will be the investors themselves.

Uncertainty is actually the friend of the buyer of long-term values."

Investment Philosophy

Successful investing doesn’t happen by accident, and our proven track record of investing hundreds of millions of dollars for clients speaks for itself. We take pride in doing what most advisers are not willing to do, which is acknowledging what we do not know, rather than attempting to convince clients that we have a tightly guarded secret or magic wand.

What we do know is that risk management is the most important aspect in wealth creation. People do not fail in investing because they miss the best opportunities. Rather, they fail when they get caught up in investments that sound too good to be true or when they chase instant returns.

Our role is to ensure that you achieve the return that is there for the taking, and hold on to those financial returns for the long-term. Indeed, we want to see those returns steadily multiply by our thorough and clear-eyed investing and our steady, reliable approach to risk-management. It’s that simple.

As Benjamin Graham, Warren Buffett’s mentor, once said “to invest successfully over a lifetime does not require a stratospheric IQ, unusual business insight or insider information. What is required is a sound intellectual framework for making decisions, and the ability to keep emotions from corroding that framework”.

Our investment philosophy is based on the following core guiding principles.

1

Let markets work for you

The market is an effective information-processing machine. Millions of participants buy and sell securities in the world markets every day, and the real-time information they bring helps set prices.

2

Invest, don’t speculate

Over time, only a small fraction of money managers outperform the market after fees, and it is difficult to identify them in advance.

3

Take a long-term approach

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

4

Consider the drivers of returns

Academic research has identified these equity and fixed income dimensions, which point to differences in expected returns. These dimensions are pervasive, persistent, and robust and can be pursued in cost-effective portfolios.

5

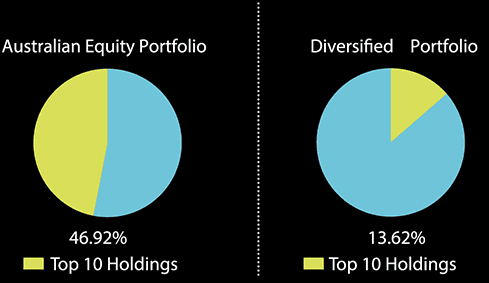

Practise smart diverification

It’s not enough to diversify by security. Deeper diversification involves geographic and asset class diversity. Holding a global portfolio helps to lower concentration in individual securities and increase diversification.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their Performance does not reflect the expenses associated with the management of an actual portfolio.

6

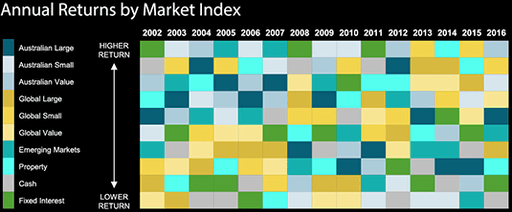

Avoid market timing

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to capture returns wherever they occur.

7

Manage your emotions

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions at the worst times.

8

Look beyond the headlines

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future while others tempt you to chase the latest investment fad. When tested, consider the source and maintain a long-term perspective.

9

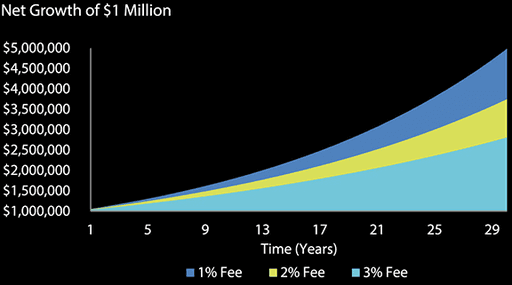

Keep costs low

Over long time periods, high costs can drag down wealth accumulation in a portfolio. Costs to consider include: Management fees, fund expenses and taxes.

10

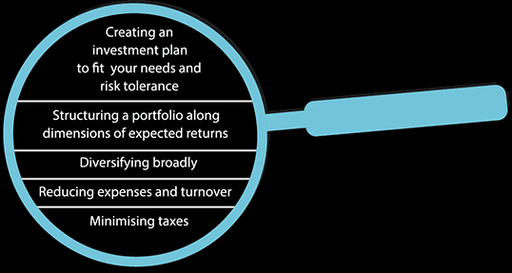

Focus on what you can control

A financial adviser can create a plan tailored to your personal financial needs while helping you focus on actions that add value. This can lead to a better investment experience.

Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustrative purposes only. See back page for additional information and important disclosures.