The Emotional Rollercoaster of Investing

Oct 31, 2024

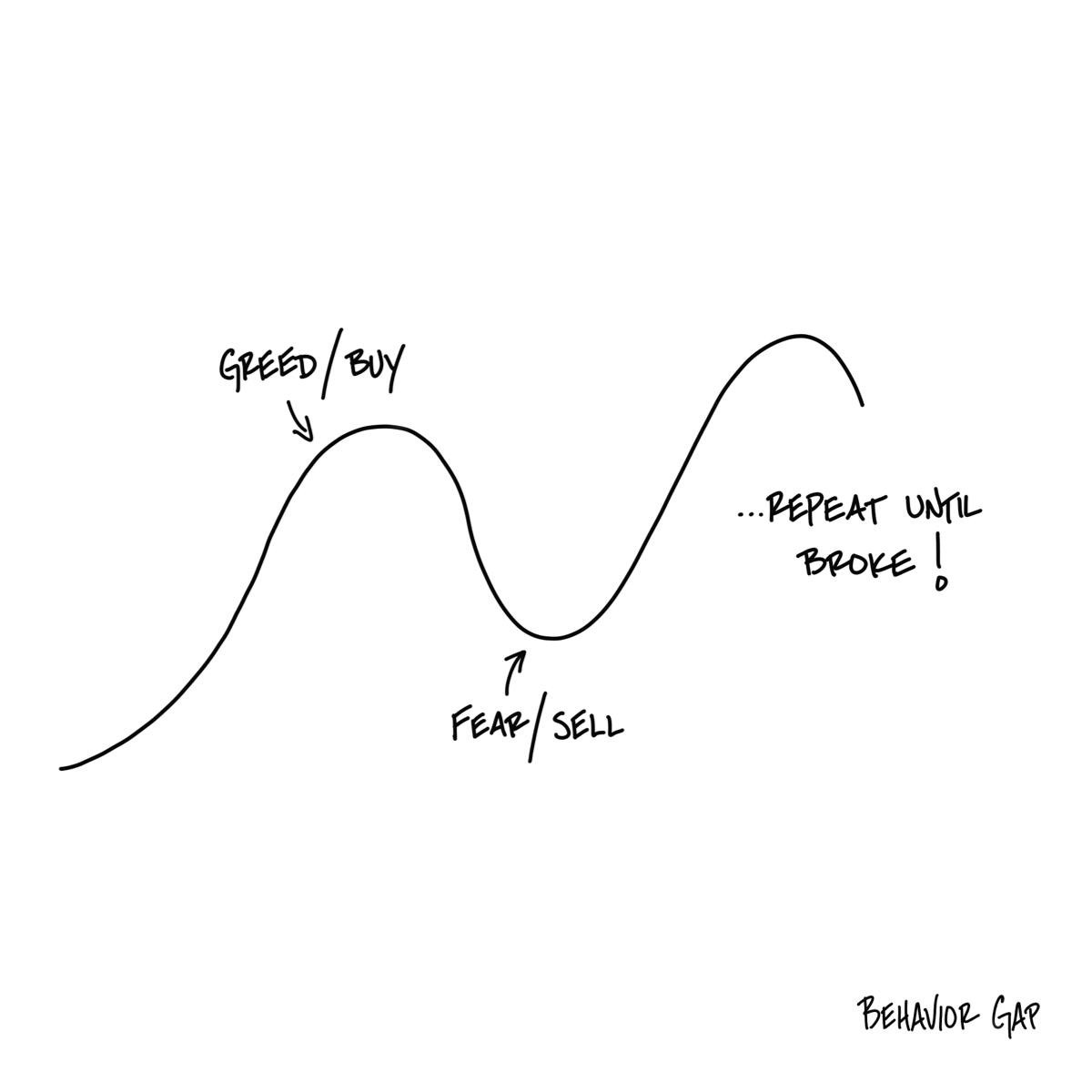

Credit – Carl Richards, Behaviour Gap – Fear & Greed

I’ve seen firsthand how easy it is for emotions to influence investing decisions. Whether it’s the excitement during a market high or the fear that kicks in when markets dip, it’s completely natural to feel that way. But letting those emotions dictate your actions is where things can start to go wrong.

The Cycle of Fear and Greed

When markets are at their peak, we often feel an overwhelming urge to jump in, driven by the sense that we might miss out on gains. On the other hand, when the market takes a dive, panic sets in, and many rush to sell to avoid further losses. The problem with this behaviour is that it pushes us to buy when prices are high and sell when prices are low— the exact opposite of what successful investing requires.

As one of my mentors, Kevin Bailey, used to say… ‘whether it’s socks, or jocks, or stocks… always try to buy them when they are on sale. Avoid the trap most people follow. For example, if the store increases prices by 30%... you wouldn’t celebrate and say “I’ll take more please!”

Why This Happens

The reality is, we’re hardwired to avoid pain and seek pleasure— instincts that have served us well throughout human history… especially thousands of years ago when we were running away from saber toothed tigers. However, in investing, these instincts can lead us astray. When we see others making moves, it’s easy to feel like we should follow suit, even if the decision isn’t based on sound strategy.

At Rasiah Private Wealth Management, we emphasise the importance of staying grounded during market highs and lows. Our job is to help you maintain a balanced perspective, ensuring that you make decisions aligned with your long-term financial goals, not short-term market movements.

Keeping Your Emotions in Check

The key to overcoming this emotional rollercoaster is to focus on a disciplined investment strategy. Rather than reacting to market swings, we guide our clients to remain patient, maintain diversification, and think long term.

It’s not about chasing the next big thing or following the crowd— it’s about sticking to principles that have proven to work over time. And when you can avoid letting fear and greed control your decisions, you’re far more likely to build and preserve wealth.

The Bottom Line

Investing is as much about managing your emotions as it is about choosing the right assets. At Rasiah Private Wealth Management, we work with you to develop an investment strategy that fits your personal values and financial goals, so that you don’t have to worry about every market dip or surge. And if you ever feel unsure, we’re here to offer the guidance and clarity you need.

—Thabojan