The Real Reason Investors Miss Out on Returns

Feb 25, 2025

Investing is often described as a game of numbers, but the truth is, it’s also deeply tied to our emotions and behaviour. At Rasiah Private, we’ve seen time and time again that the difference between a successful investor and one who falls short isn’t just market performance— it’s their own actions.

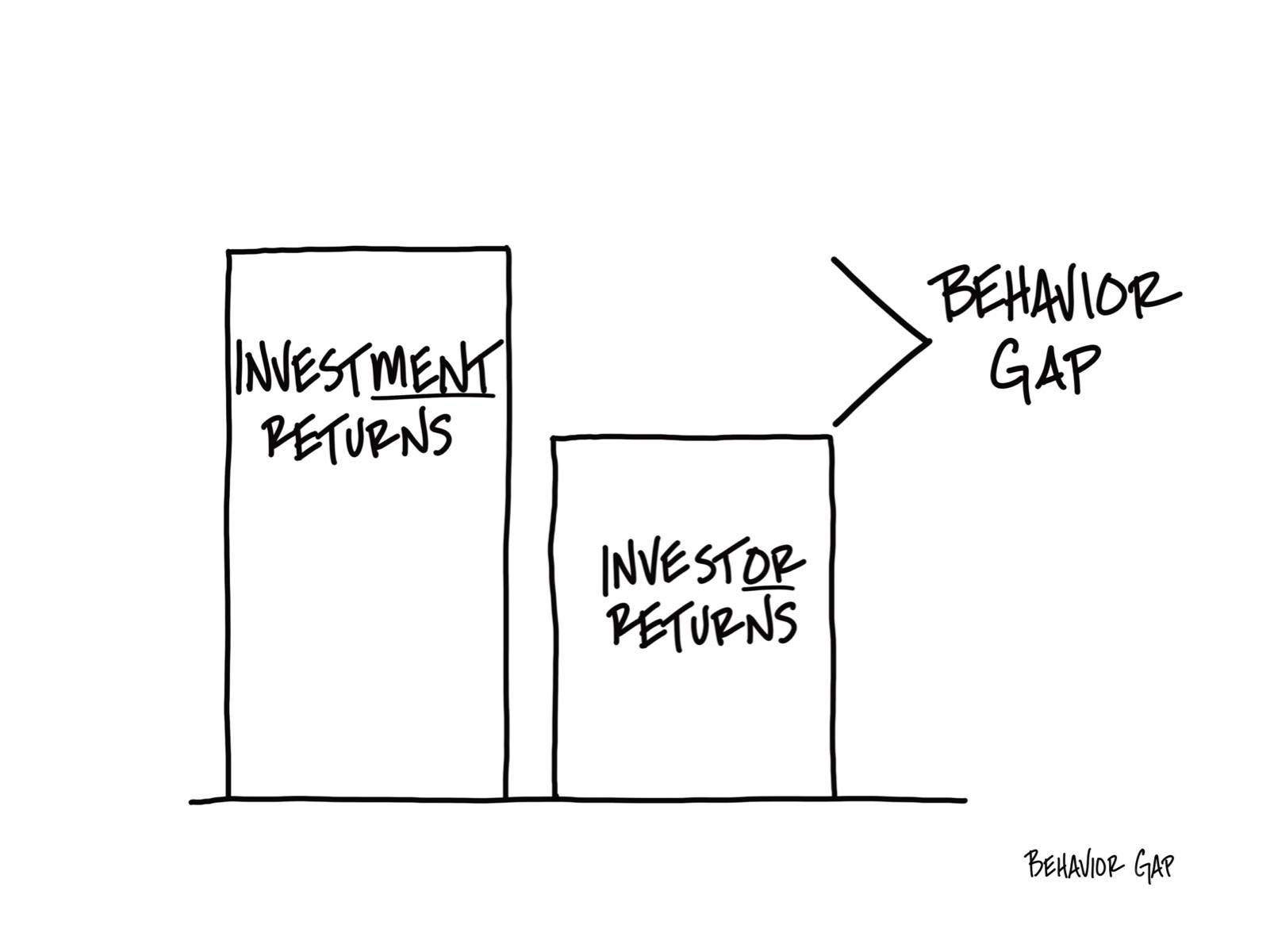

Carl Richards, author and creator of the Behaviour Gap, coined a powerful term that explains this phenomenon: “The Behaviour Gap.” It’s the difference between the returns that investments generate and the returns that investors actually earn due to their own decisions. Let’s explore how this plays out and what we can do about it.

What Are Investment Returns?

Imagine you invest in a fund that yields 10% annually over 10 years. That 10% per year is the investment return— the growth the investment itself generates if left untouched.

But here’s the catch: how many of us truly leave investments untouched for that long?

The Gap Between Potential and Reality

Investor returns tell a different story. Research shows that most investors hold long-term investments for just two to three years before selling. Often, they move on to the next “hot” opportunity, chasing trends and reacting to short-term market movements.

As Carl Richards points out, “The return happens, but we just aren’t there to get it.” Instead of staying the course, we sell during downturns and buy during upswings. The result? We miss out on the full potential of the investments we worked so hard to choose.

Why We Fall Into the Gap

Many investors believe that to succeed, they need to always be searching for the next best investment. But this well-intentioned behaviour leads to a cycle of buying high and selling low— a pattern that consistently undermines their returns.

The irony is that long-term success often requires less activity, not more. A disciplined, patient approach is the antidote to the behaviour gap.

How to Close the Gap

The good news is that this gap is entirely avoidable. Success as an investor doesn’t require constant activity or a knack for predicting trends. Instead, it comes down to this:

Patience. Let your investments work for you over time.

Discipline. Resist the urge to react to every market shift.

Clarity. Have a clear financial plan tied to your goals and values.

At Rasiah Private, we believe in helping clients navigate their emotions and stay focused on their long-term objectives. The markets will rise and fall, but your strategy shouldn’t waver with every fluctuation.

A Final Thought

Becoming a better investor starts with understanding your own behaviour. As Carl Richards reminds us, “Investing is simple, but it’s not easy.” Focus less on chasing returns and more on aligning your investments with your goals. When you trust the plan and stay the course, you’ll find yourself reaping the rewards of your patience and discipline.

The next time you feel the urge to make a quick move, ask yourself: Am I helping my investments, or am I getting in the way?

Let’s work together to close the gap and ensure you’re earning what your investments promise.